China Topscom Delivered A Speech About Analysis of Electronics contract Manufacturing Outsourcing Industry in China On 2019 CITE China Information Technology Expo Fair.

Keywords: china electronics contract manufacturing outsource industry,pcb boards assembly,pcba,EMS market.

I. Overview of China's Electronic contract Manufacturing Outsourcing Industry.

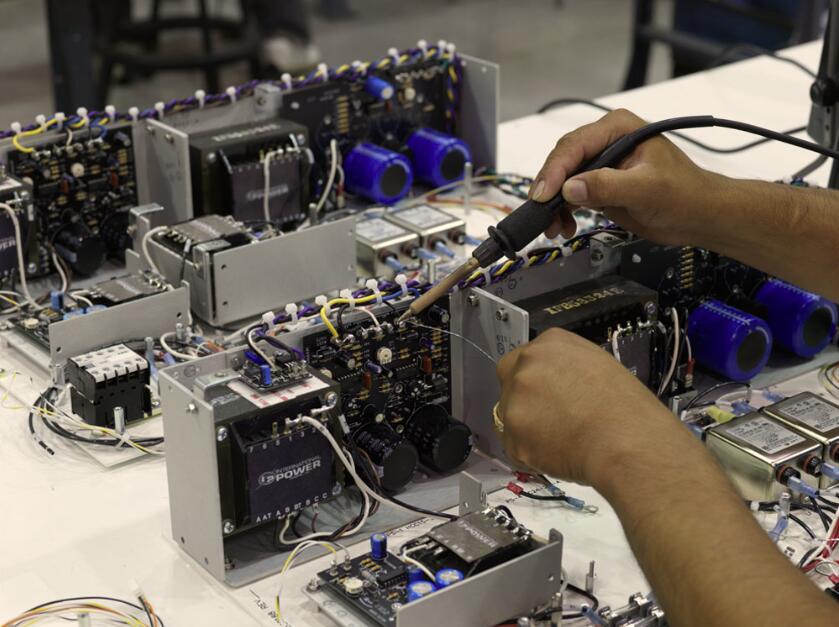

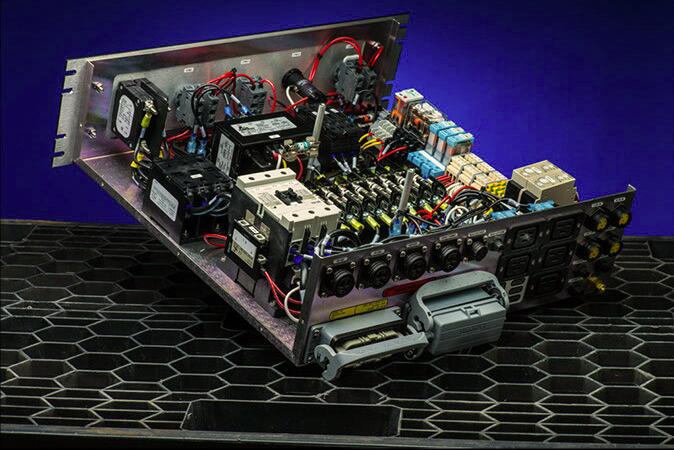

By definition, outsourcing (Outsourcing) refers to the economic activities that an enterprise outsourced to a professional manufacturing or service provider outside the enterprise after stripping out the basic, common, non-core business and information technology-based business processes originally provided by itself in the value chain. Electronic contract manufacturing outsourcing(EMS), is also called Electronic contract manufacturing service,which is the product of the combination of Electronic contract manufacturing and outsourcing industry. the initial business of EMS is only to mount printed circuit boards ((PCB),) on behalf of customers. today, the services provided by EMS have been greatly expanded, including product design, engineering, testing, material procurement, etc., in addition to (PCB) placement of printed circuit boards. However, (PCB) placement of printed circuit boards is still the core basic business provided by EMS.

In the traditional Electronic contract manufacturing industry, manufacturers themselves complete the links from product development and design, raw material procurement to product manufacturing, and sell products with their own brands. With the continuous development of the market and the improvement of the fierce market competition, manufacturers gradually outsource the production, development and design of products to other enterprises in order to expand market share, effectively reduce production costs, rapidly expand product production capacity, shorten the time of new product development, and so on, while they begin to gradually shift the focus of development to brand management and channel construction. As a result, there is a professional division of labor between brands and Electronic contract manufacturing outsourcing service providers in the Electronic contract manufacturing industry. the article is posted by Dr.Chai Lianxing,vice president of Topscom,china Topscom provide high difficulty density & printed circuit boards PCB design & layout, mass manufacturing & fabrication,pcba boards assembly,turnkey full systems integration electronic contract manufacturing services.

2. Electronic contract manufacturing outsourcing industry chain.

The upstream of the Electronic contract manufacturing outsourcing industry is electronic components, such as semiconductors, PCB, passive electronic components (resistors, capacitors, etc.), and downstream is the brand manufacturers of communication products such as computers, mobile phones, tablets and consumer electronics.

II. Analysis of Electronic contract manufacturing Outsourcing Industry.

- Analysis of Global Electronic contract manufacturing Outsourcing Industry.

- the size of the industry is expected to reach US $750 billion in 2020.

The electronics manufacturing outsourcing market was about $363.8 billion in 2019, down 0.3% from 2018, mainly due to a sharp decline in laptop shipments. With the increasing maturity of the Electronic contract manufacturing outsourcing business model and the continuous improvement of the service capacity of contract manufacturing service providers, the service field of the global Electronic contract manufacturing contract manufacturing industry is getting wider and wider, and the total amount of outsourcing is increasing year by year. At present, Electronic contract manufacturing contract manufacturing services have covered household appliances, network communications, consumer electronics, automotive electronics, medical equipment, aerospace and other fields. Market research firm iSuppli reports that the total amount of global Electronic contract manufacturing outsourcing EMS (Electronic contract manufacturing Services, Electronic contract manufacturing services) is about $600 billion in 2019, and the industry is expected to maintain a relatively high rate of expansion and its revenue will reach $750 billion by 2020.

(2) the level of industry profit margin will remain stable.

According to the analysis of iSuppli, the gross profit margin of the global Electronic contract manufacturing service industry is about 5.00% to 10.00%, of which the gross profit margin of EMS industry is basically stable at 5.00% to 8.00%, and will maintain the above gross profit margin in the next few years. At present, the domestic Electronic contract manufacturing contract manufacturing service industry has the advantages of low labor cost and low rental cost. the average gross profit margin of enterprises is slightly higher than the global average, and the gross profit margin of domestic dominant enterprises is estimated to be more than 10.00%.

(3) Industry competition pattern.

The most potential Electronic contract manufacturing outsourcing market in the next five years is still the mobile phone market. Xiaomi's success makes the best promotion for Electronic contract manufacturing outsourcing services. Xiaomi focuses on market hype and brand promotion, handing over the manufacturing part to the outsourced manufacturers. Xiaomi has achieved great success, which has stimulated many mobile phone companies to switch to Xiaomi mode, opening up a broad space for Electronic contract manufacturing outsourcing manufacturers. Apple, Samsung and LG are also likely to outsource a small amount of manufacturing business to Electronic contract manufacturing outsourcing manufacturers in the future. the Electronic contract manufacturing outsourcing market for communication terminals is expected to grow from $50.8 billion in 2019 to $55.2 billion in 2017. There are about 300m 350 companies in the global Electronic contract manufacturing outsourcing industry, with a very high concentration of the industry. The top eight companies occupy about 81 per cent of the market share, and these big enterprises have grabbed big customers.

According to the location of the corporate headquarters, Taiwan is the heart of the global electronics industry, and about 75% of the world's Electronic contract manufacturing outsourcing industry is Taiwanese enterprises. ranked by revenue are Hon Hai, Quanta, Pegatron, Compal, Weitron, Yingyeda, New Jinbao, Huanlong Electric company.

2. Analysis of domestic Electronic contract manufacturing Outsourcing Industry.

(1) low cost and manufacturing capacity transfer benefit the EMS market in mainland China.

Geographically, the global EMS industry began in Europe and the United States, and then developed to South America, Southeast Asia and Taiwan, followed by mainland China, that is, moving in the direction of lower and lower costs and a bigger and bigger market. Mainland China and Taiwan have become the most important regions in the global EMS field because of their good investment environment, expanding middle class and cheap high-quality labor.

In several manufacturing bases around the world, China is quite competitive, whether it is the cost of assembly workers or engineers. Therefore, in terms of demand and labor costs, China is still the preferred place for global brands to transfer capacity. According to the forecast of Henderson Ventures, the growth rate of China's electronic output value will lead other major Electronic contract manufacturing regions in the world, reaching more than 20.00% in the next few years.

(2) the industrial scale and market scale are gradually expanding.

In 2018, the total sales revenue of China's electronic information industry reached 12.4 trillion yuan, an increase of 12.70 percent over the same period last year. Among them, the main business income of the electronic information manufacturing industry above the scale reached 9.3 trillion yuan, an increase of 10.40 percent over the same period last year; software and information technology services achieved software business revenue of 3.1 trillion yuan, an increase of 24.60 percent over the same period last year. In 2019, the added value of China's above-scale electronic information manufacturing industry increased by 12.2%, and the growth rate increased by 0.1% compared with the same period last year, leading to 3.7% of the industrial average in the same period. The revenue of software and information technology services reached 3.7 trillion yuan, an increase of 20.2% over the same period last year, which was higher than the national industrial income growth rate of more than 10%. The total revenue and profits of the electronic information manufacturing industry above scale accounted for 9.3% and 7.2% of the overall industry, respectively, up 0.2% and 0.6% from the same period last year.

In the global electronics industry, there is still much room to improve the EMS/ODM penetration rate of the network equipment industry and the consumer electronics industry. Coupled with the huge market spawned by China's huge population base, the network equipment industry and the consumer electronics industry, especially terminal products, will be the key areas for the continuous growth of domestic Electronic contract manufacturing outsourcing service business in the next few years.

(3) the improvement of the strength of domestic enterprises.

In 2019, in China's electronic information manufacturing industry, the sales output value of domestic enterprises reached 3.0975 trillion yuan, an increase of 18.50 percent over the same period last year, which was 7.50 percent higher than the industry average; the sales output value of three foreign-funded enterprises reached 6.2917 trillion yuan, an increase of 7.70 percent over the same period last year, and the growth rate was 3.30 percent lower than the average; and the proportion of sales output value of domestic enterprises reached 33.3 percent, an increase of 2.10 percent over 2018.

(4) the high growth rate of foreign trade tends to stabilize.

In 2019, the total import and export volume of China's electronic and information products reached 133 billion US dollars, an increase of 12.10 percent over the same period last year, and the growth rate was higher than the national total import and export level in the same period (4.50. Of this total, exports totaled 780.7 billion US dollars, an increase of 11.90 percent over the same period last year, which was 4.00 percent higher than that of the country's foreign trade exports, accounting for 35.30 percent of the country's foreign trade exports, an increase of 1.2 percent over the previous year, and contributing 51.1 percent to the growth of the country's foreign trade exports. Imports totaled 549.5 billion US dollars, an increase of 12.40 percent over the same period last year, which was 5.10 percent higher than that of the country's foreign trade imports, accounting for 28.20 percent of the country's foreign trade imports, an increase of 1.30 percent over the previous year, and contributing 45.7 percent to the country's foreign trade import growth. Judging from the trend of imports and exports for the whole year, it shows a trend of gradual stabilization.

(5) the benefit level of electronic information manufacturing enterprises has been improved.

From January to November 2019, the electronic information manufacturing industry above scale completed 9.1993 trillion yuan in main business income, an increase of 9.8 percent over the same period last year; total profits reached 402.3 billion yuan, an increase of 22.9 percent over the same period last year; and taxes paid were 164 billion yuan, an increase of 11.1 percent over the same period last year. The industry's average profit margin was 4.4%, up 0.5% from a year earlier. From a quarterly point of view, in the first quarter, the first half of 2014 and the first three quarters of 2014, the industry's profit margins were 3.2%, 4.0% and 4.1%, respectively.

(6) the competition pattern of domestic industry.

The domestic Electronic contract manufacturing outsourcing service industry has made great progress in recent years, but this growth mainly comes from the transfer of global Electronic contract manufacturing capacity to China. From the perspective of the market pattern, at present, most of the first-tier companies in the domestic Electronic contract manufacturing outsourcing service industry are foreign-funded enterprises invested by international companies and Chinese Taiwan companies in mainland China, and occupy most of the market share. At present, local enterprises are basically in the second-and third-line position in the domestic market, and most of them belong to the EMS customers business model. Except for a few enterprises with certain scale and strong design, manufacturing and comprehensive service capabilities, which have won some large customer resources and market share, most of the other enterprises are still small in scale, weak in manufacturing and service capabilities, and mainly rely on their own flexibility and simple customized services to make profits.

Although local enterprises are still in a weak position in the competition with foreign-funded enterprises, the huge domestic consumer market, growing technical and management personnel, rich low-cost labor force and so on, it still provides a good environment for the sustainable development of local enterprises. A number of local enterprises with good development situation, with their own competitive advantages and large customer resources are expected to achieve rapid growth in the next few years and become the main manufacturers in the domestic Electronic contract manufacturing outsourcing service industry. In the field of network communication terminal equipment and portable consumer electronic products, local enterprises are expected to achieve greater development.

(7) domestic market layout.

At present, the domestic Electronic contract manufacturing outsourcing service enterprises are mainly concentrated in the economically developed eastern coastal areas, and the Electronic contract manufacturing outsourcing service enterprises in the Pearl River Delta, Yangtze River Delta and Bohai Rim occupy most of the market share of the country. Among them, the first in the Pearl River Delta, the second in the Yangtze River Delta and the third around the Bohai Sea, the Bohai Rim area with Tianjin as the leader, as a new economic hot spot, has great potential for development, strong growth momentum, relatively sufficient energy and high-quality human resources, coupled with good introduction policies, it is bound to attract southern enterprises to invest northward. It is expected that the Pearl River Delta, Yangtze River Delta and Bohai Rim will still be the investment-intensive areas of the domestic Electronic contract manufacturing outsourcing service industry in the future.

(8) the level and changing trend of industry profit margin.

At present, the domestic Electronic contract manufacturing outsourcing service industry has the advantages of low labor cost and low rental cost. The average gross profit margin of enterprises is slightly higher than the global average level of 5%. The gross profit margin of domestic advantageous enterprises is estimated to reach more than 10%. Among them, the gross profit margin of ODM companies is slightly higher than that of EMS enterprises. It is expected that the profit level of the domestic Electronic contract manufacturing outsourcing service industry will remain relatively stable in the next few years.