China Topscom posted article on china daily news about review and prospect of China's Electronics Manufacturing Industry after the epidemic in 2020.

Semiconductor sector: short-term overall pressure on the industry, long-term benefits continue to benefit.

The industry has entered a period of consolidation since 2017, and now the prosperity of the industry has bottomed out and rebounded, showing a low before and a high trend in 2019 as a whole. Judging by the year-on-year changes in North American semiconductor equipment shipments, there are obvious signs of recovery in the semiconductor manufacturing industry, and the current global semiconductor sales are showing a growth trend compared with the same period last year. The semiconductor industry is one of the most important underlying structures of the national new economy, and the core logic of "domestic substitution" remains unchanged. There has been no substantial change in the US national strategy and policy toward China, and the country has vigorously promoted the development of industries such as 5G infrastructure, new energy, security, trust and innovation, and new consumer electronics, and the semiconductor sector will continue to benefit.

The performance of packaging and testing enterprises improved as a whole at the end of last year, and at the same time, affected by the warming inertia of annual prospects and the epidemic situation, the performance of leading semiconductor equipment companies showed differentiation in the first quarter of this year. China's wafer manufacturing enterprises have ushered in a period of intensive construction, and upstream equipment companies have full orders. IC design companies are mainly driven by downstream market demand, the short-term epidemic has a greater impact on consumer electronics, downstream demand is expected to pick up in the second half of the year. In the medium and long term, leading design companies with core technical barriers are given priority to benefit from policies such as 5G, Internet of things, data center, automotive electronics and so on.

Electronic components: strong demand downstream, high prosperity of the industry.

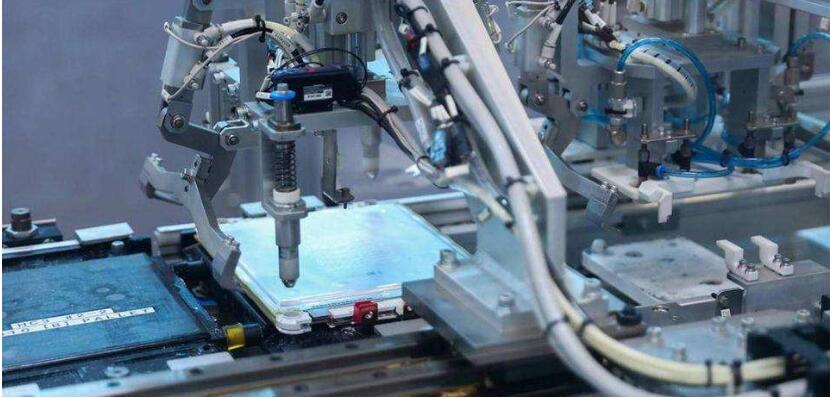

Benefiting from the volume of 5G base station construction, the prosperity of the printed circuit board industry has continued to improve in the last two quarters. PCB&CCL manufacturers represented by Shengyi Technology, Shennan Circuit and Shanghai Power Co., Ltd. maintained a high rate of revenue growth in 2019 and the first quarter of 2020. With the acceleration of base station construction in 2020 and the technological upgrading of PCB manufacturers such as Jingwang Electronics and Dongshan Precision, more orders related to base stations are expected to be obtained. In addition to the construction of 5G base stations, the large-scale construction of data centers and the use of network equipment such as servers, routers and switches will also increase the demand for PCB and become a medium-and long-term driving force for printed circuit boards.

In 2019, passive components are in the de-inventory stage, and the performance of related companies in the industry is affected to a certain extent. In the short term, affected by the epidemic, the short-term supply and demand of passive components are restrained to a certain extent, and prices are expected to remain stable in the future. In the long run, stimulated by new energy vehicles, 5G mobile phones and other downstream areas, the demand for passive components will continue to increase steadily; supply-side enterprises represented by Fenghua Hi-Tech and Sanhuan Group have launched production expansion plans, and related enterprises have broad room for growth.

Electronic manufacturing: affected by the epidemic in the short term, it is expected to recover quickly in the second half.

In the first quarter of 2020, both industry revenue and gross profit showed a year-on-year increase, with a distribution increase of 9.22% and 10.17%, which were not affected by the epidemic. The reasons are as follows: (1) the overseas business of most related companies in electronic manufacturing accounts for a large proportion, and the overseas business in the first quarter has not been affected by the epidemic; (2) most of the orders of consumer electronics are in advance, and most of the revenue in the first quarter is orders before the Spring Festival, and the sharp increase in accounts receivable compared with the same period last year shows that there is a certain pressure on the industry to pay back.

Due to the spread of the overseas epidemic, the electronic manufacturing sector may be under pressure in the second quarter, but with the gradual resumption of overseas work and the rapid increase in the penetration of 5G mobile phones, the electronic manufacturing sector is expected to recover in the second half of the year.

Hello, welcome to visit our official website!

+86 13502814037 (What's up)sales@topscompcbassembly.com

Turnkey Pcba Assembly & Contract Electronic OEM Manufacturing Provider